Background

Recently, it was announced by MikeMirzayanov that NEAR would be contributing to the funding of Codeforces. Clearly, the influx of additional funding was very important to Codeforces. In this blog I want to look at the NEAR cryptocurrency in more detail, and analyze the possibility of a complete collapse.

The Story of Terra Luna

Between May 5 and May 12th, the cryptocurrency Terra Luna lost all of it's value: wiping $45 billion off of the crypto market.

Between May 5 and May 12th, the cryptocurrency Terra Luna lost all of it's value: wiping $45 billion off of the crypto market.

What were the "fundamental design mistakes" (according to the Binance CEO) of Terra Luna? Perhaps simply the entire idea of an algorithmic stable coin.

A "stable coin" is merely a cryptocurrency whose value is supposed to remain fixed, usually relative to the dollar. For example, the stable coin USDC has had a maximum price deviation of only a tenth of a percent from its pegged value of 1 US dollar.

The so-called breakthrough of Terra Luna was a "decentralized" stablecoin that was not tied to a governmental currency. The blockchain was home to two cryptocurrencies: Terra (UST), which was supposed to be a stablecoin fixed at 1 dollar, and Luna (LUNA) which was supposed to be a normal volatile cryptocurrency.

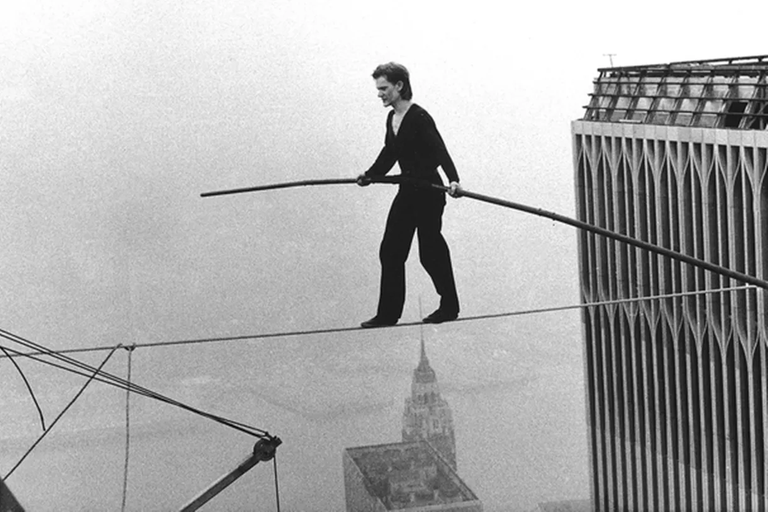

A Crypto Balanced on a Tightrope

A sophisticated algorithm linked Terra with Luna. Luna was used to maintain Terra's stability, and Terra's stability was used to preserve Luna. The final fallback was $3 billion in Bitcoin reserves.

A sophisticated algorithm linked Terra with Luna. Luna was used to maintain Terra's stability, and Terra's stability was used to preserve Luna. The final fallback was $3 billion in Bitcoin reserves.

An accurate analogy was that Terra Luna was like a tightrope walker.